Spotlight: Food & Beverage Investment in New York State

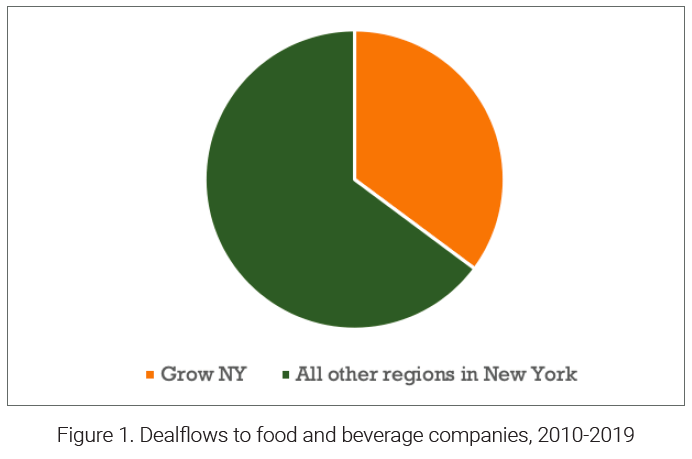

New York State’s food and beverage manufacturing companies have brought in $2.3 billion in private capital investment since 2010, according to a Center for Regional Economic Advancement (CREA) analysis of data collected by CB Insights1. The Grow-NY region, comprising 22 counties in the Finger Lakes, Central New York and Southern Tier, captured 38%, or $886 million, of the state total (see Fig.1).

The Grow-NY region’s abundant resources and long history of excellence in food and agricultural production have attracted significant investment over the past decade. In 2014, the yogurt maker Chobani struck a major deal with TPG Capital, which loaned Chobani $750 million to grow its business. Chobani, which has production facilities in Chenango County (part of the Southern Tier), stated in 2014 it would use the investment to “build…momentum, fund our exciting new innovations and reach new people.”2 The Chobani deal made up a large share of statewide investment activity in dairy products, a total of $862 million since 2010, but thanks to Chobani and others, nearly 92%, or $788 million of statewide investment in dairy products has gone to companies located in the Grow-NY region. Besides dairy, the Grow-NY region also captured $55 million in investment in meat, fish, seafood and alternative proteins, $34 million in non-alcoholic beverages, $5.25 million in canned and frozen foods, and $2.8 million in ingredients, flavoring and condiments across the same span of time.

Grow-NY food and beverage manufacturing contributed significantly to the region’s economic growth. Food and beverage employment has grown 33% since 2009, according to data from the New York State Department of Labor.

Investing in Food & Beverage Startups

The top 5 investors in New York State’s food and beverage space by number of deals are: AccelFoods, with 28 deals in the past five years, followed by CircleUp with 14 deals. Chobani Food Incubator and Food-X each closed nine deals, followed by Lerer Hippeau Ventures with eight deals.

Of the region’s investments in early-stage food and beverage companies, the non-alcoholic beverages industry raised the most with $17.6 million going to the cherry juice-maker, CheriBundi. The canned and frozen foods industry came next with $5.25 million to oats-based frozen meals innovator, Grainful, and a $2.7 million corporate minority stake from contract manufacturer, LiDestri, to hummus-maker Ithaca Cold-Crafted. Chobani Food Incubator also invested $300,000 each in Grainful and Ithaca Cold Crafted, according to CB Insights data, companies that also participated in Chobani’s Food Incubator program.

While the Grow-NY region captured $886 million in overall investment in food and beverage since 2010, the numbers look quite different when looking only at deals made by venture capital, angel investors, crowdfunding and seed rounds. Excluding mergers, acquisitions and major loans to established companies could provide a better snapshot of investment activity for startups in the region. From 2010-2019, the Grow-NY food and beverage startups raised $22 million from venture capital, angel or seed investors, according to CB Insights data.

The National Stage

New York State’s $2.3 billion dealflow from 2010-2019 into the food and beverage industry ranks fourth in the United States, behind Illinois’s $13.5 billion, California’s $7.8 billion, and Missouri’s $2.5 billion. These numbers, however, are again skewed by mergers and acquisitions. For example, of Illinois’ $13 billion in financing activity captured by CB Insights, $12 billion is represented by the sale of SABMiller’s stake in Chicago-based MillerCoors to Anheuser-Busch.

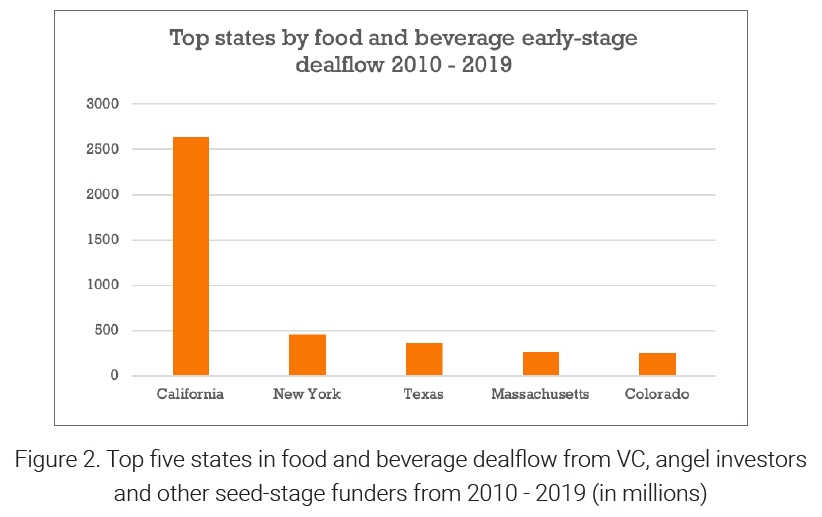

Keeping only dealflows from seed rounds, angel investors, incubators, and venture capitalists, New York State overall ranks second with $445 million in fund flows, second only to California’s $2.6 billion, despite having less than half of California’s population and agricultural land.³ (see Fig.2)

About CREA

The Center for Regional Economic Advancement fuels economic growth and diversity in Upstate New York through entrepreneurship and innovation. We support and empower people to to start and grow new ventures.

Contact

Research contributed by Adi Menayang. Contact Christine Mehta at crea-research@cornell.edu with questions or more information.